mississippi state income tax form

Earned Income Credit EITC Advance Child Tax Credit. 159 enacted on May 6 2021 Montanas top marginal individual income tax rate was reduced from 69 to 675 percent on January 1 2022.

Amp Pinterest In Action Bar Graph Template Questionnaire Template Income

Detailed Oklahoma state income tax rates and brackets are available on this page.

. Type of federal return filed is based on your personal tax situation and IRS rules. Start filing your tax return now. Printable New Jersey state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

This website provides information about the various taxes administered access to online filing and forms. To check the status of your Mississippi state refund. 80-108 Itemized Deductions Schedule.

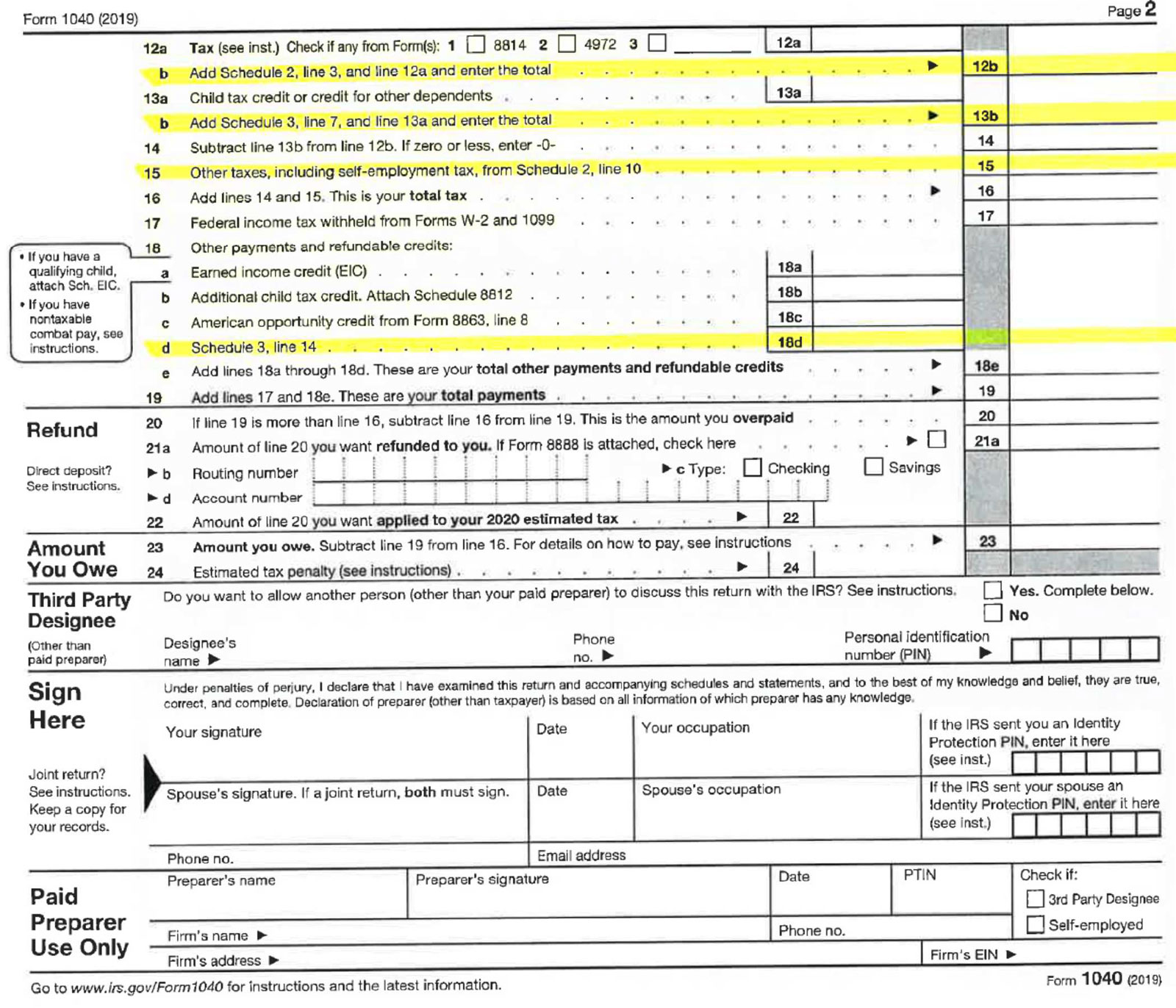

If you have not done so already please begin with your federal form 1040Remember that federal tax forms 1040EZ and 1040A have been discontinued. 80-160 Credit for Tax Paid Another State. Form M1 is a Minnesota Individual Income Tax form.

Preparation of your Georgia income tax forms begins with the completion of your federal tax formsSeveral of the Georgia state income tax forms require information from your federal income tax return for example. POPULAR FORMS. New Jersey state income tax Form NJ-1040 must be postmarked by April 18 2022 in order to avoid penalties and late fees.

Yes there is a difference. 80-205 Non-Resident and Part-Year Resident Return. SC-1040 can be eFiled or a paper copy can be filed via mail.

And shall be allowed a credit against income taxes in an amount equal to his or her pro rata or. Start filing your tax return now. States either use their own state W-4 form or the federal Form W-4.

80-315 Re-forestation Tax Credit. State sales tax growth was 14 percent in 2016 and estimated to be slightly less in 2017. 2021 Minnesota Individual Income Tax Forms and Instructions Form M1 Minnesota Individual Income Tax Return Schedule M1W Minnesota Income Tax Withheld Schedule M1SA Minnesota Itemized Deductions Schedule M1MA Marriage Credit Schedule M1WFC Minnesota Working Family Credit Schedule M1REF Were here for you.

Detailed South Carolina state income tax rates and brackets are available on this page. Small Business Events in Your Area. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain.

Form 511 NR. The Magnolia State now effectively exempts the first 5000 of taxable income while assessing a 4 percent tax on the next 5000 and a 5 percent tax on all taxable income above 5000. Unless an employee works in a state with no state income tax they must complete the required W-4 state form when starting a new job or each year to make sure their allowances are met.

We would like to show you a description here but the site wont allow us. 5 - February 28 2018 at participating offices to qualify. While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules and.

Form 511 can be eFiled or a paper copy can be filed via mail. TAX DAY NOW MAY 17th. Instructions for Form 1040 Form W-9.

Is There A Difference Between a State W-4 and a Federal W-4. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Form 511 is the general income tax return for Oklahoma residents.

80-106 IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107 IncomeWithholding Tax Schedule. Individual Tax Return Form 1040 Instructions. On August 30 2007 a report by the United States Census Bureau indicated that Mississippi was the poorest state in the country.

For purposes of assessment for ad valorem taxes taxable property is divided into five classes. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Form SC-1040 is the general income tax return for South Carolina residents.

Major cotton farmers in the.

Individual Income Tax Forms Dor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Do State And Local Individual Income Taxes Work Tax Policy Center

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

State Corporate Income Tax Rates And Brackets Tax Foundation

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Calculate Income Tax In Excel

Individual Income Tax Forms Dor

2019 Schedule Example Student Financial Aid

2019 Schedule Example Student Financial Aid

Mississippi Income Tax Calculator Smartasset

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

The Most And Least Tax Friendly Us States

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Policy Tax Forms Income Tax Income Tax Return

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

How Many Electoral College Votes Does Each U S State Have Britannica